Unlock USD Liquidity.

Everywhere You Operate.

Artoh empowers global businesses in FX-restricted markets to move USD freely — across Africa, LATAM, and beyond.

Hard Markets Run Out of Dollars.

Suppliers wait. Dividends wait. Growth waits.

Across Africa and LATAM, USD shortages, repatriation limits, and bank queues block cross-border payments — trapping capital for weeks or months. Treasury forecasts break. Operations slow. Businesses lose momentum.

USD Access is Limited

FX allocations and backlogs freeze cash flow, preventing immediate access to capital.

Imports Stall

Supplier payments wait for USD clearance, disrupting supply chains.

Repatriation is Delayed

Dividends and intercompany transfers get stuck in reviews for weeks or months.

Forecasts Fail

Treasury can't plan when settlement timing is unknown or unpredictable.

Settlement Delays

Cross-border payments stuck in processing queues for extended periods.

Artoh removes the liquidity bottleneck — delivering instant, compliant USD settlement where banks can't.

The Treasury Platform Built for

Emerging Markets.

Artoh unlocks trapped liquidity and moves capital freely — using stablecoin-powered rails that settle in hours, not weeks.

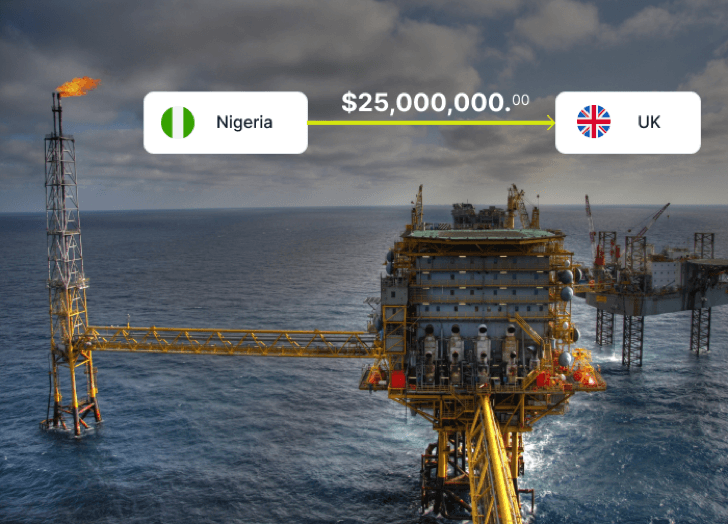

Turn FX Delays Into Instant Settlement

Fund operations, suppliers, or subsidiaries — and repatriate profits or dividends — in real time, anywhere you operate.

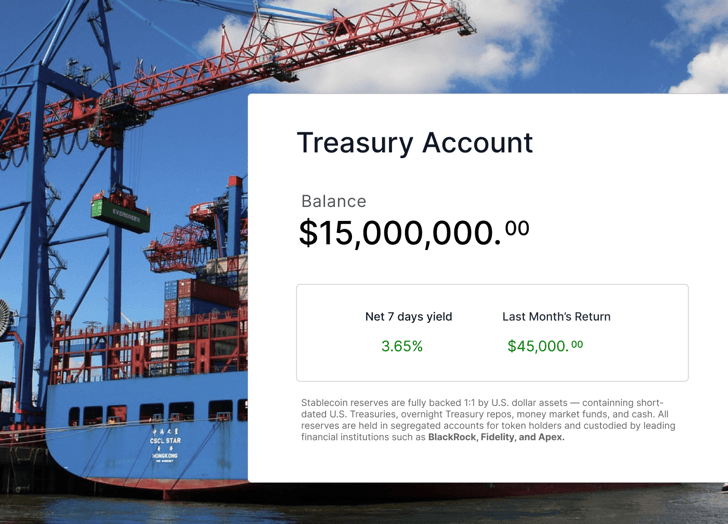

Protect Your Treasury From Local Currency Volatility

Move idle funds into USD-denominated treasury accounts backed by money-market and T-bill yield — protecting your working capital from inflation and devaluation.

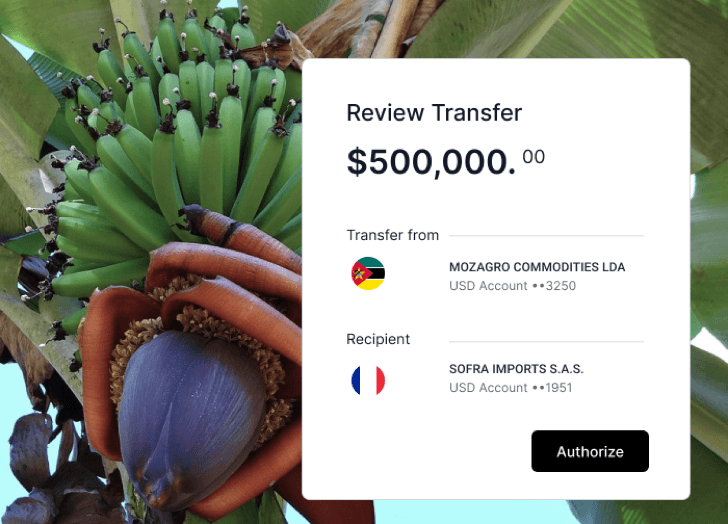

Open a Global USD Account. Receive USD From Anywhere

Accept payments directly into your Artoh treasury account through domestic rails in the U.S. and Europe — faster, cheaper, and simpler than SWIFT transfers.

Liquidity Where Banks Can't Deliver.

From agribusiness to Oil & Gas, Artoh keeps capital moving across Africa and LATAM — enabling global businesses to pay suppliers, fund projects, and repatriate profits without the wait.